The 11+ Hidden Facts of What Is Corporation Tax Rate Uk: Corporate tax rate in the united kingdom is expected to reach 19.00 percent by the end of 2021, according to trading economics global macro models and analysts expectations.

What Is Corporation Tax Rate Uk | The uk rate is relatively low when compared to other countries, and is significantly lower than personal income tax rates. The corporate tax rate in the united states is currently at a flat rate of 21%. Higher rates of income tax. Corporate tax laws and regulations covering issues in united kingdom of tax treaties and residence in general, the uk has avoided wide limitation on benefits articles and prefers specific provision in if so, at what rate or rates? The profit of a corporation is taxed to the corporation when it is earned and then is taxed to the.

Fifteen states and the district of columbia have cut corporate taxes since 2012 and several more have corporations and the double tax dilemma. When do i need to register for vat? Despite those old adverts insisting that tax doesn't have to be taxing the tax rate you use depends on the total amount of your taxable income. The second largest source are national insurance contributions, the third value added tax (vat) and the fourth largest is corporation tax. Every company liable for corporation tax pays a fixed rate of…

A resident of the united kingdom for tax purposes is a company registered in the uk or a central office and which is controlled in the uk. Corporation tax in the uk is a tax that limited companies need to pay on their profits. What are the corporation tax rates? The uk corporation tax regime does not apply to trusts, partnerships or individuals. The second largest source are national insurance contributions, the third value added tax (vat) and the fourth largest is corporation tax. This is one part of corporation tax that's nice and straightforward. These changes will remove the distinction between what types of profit different types of brought forward section 4: If more than one rate applies, calculate how much is due based on the number days each rate applied, for example, 45 days at the rate for the 2018/19 accounting year and 320. The profit of a corporation is taxed to the corporation when it is earned and then is taxed to the. I think with corporation tax, over time, what's transpired is it might not be the most effective way to drive capital investment up, which is what we want to see the last sentence days it all, they know it's not going to work but due to shrinking revenue they're forced to raise taxes. Uk tax allowances and tax rates. What were the starting rates of corporation tax. What you owe in uk tax depends on your specific situation.

What are the corporation tax rates? Corporation tax in the uk is a tax that limited companies need to pay on their profits. Every company liable for corporation tax pays a fixed rate of… The federal corporate tax rate is a flat rate that applies to all businesses. The uk rate is relatively low when compared to other countries, and is significantly lower than personal income tax rates.

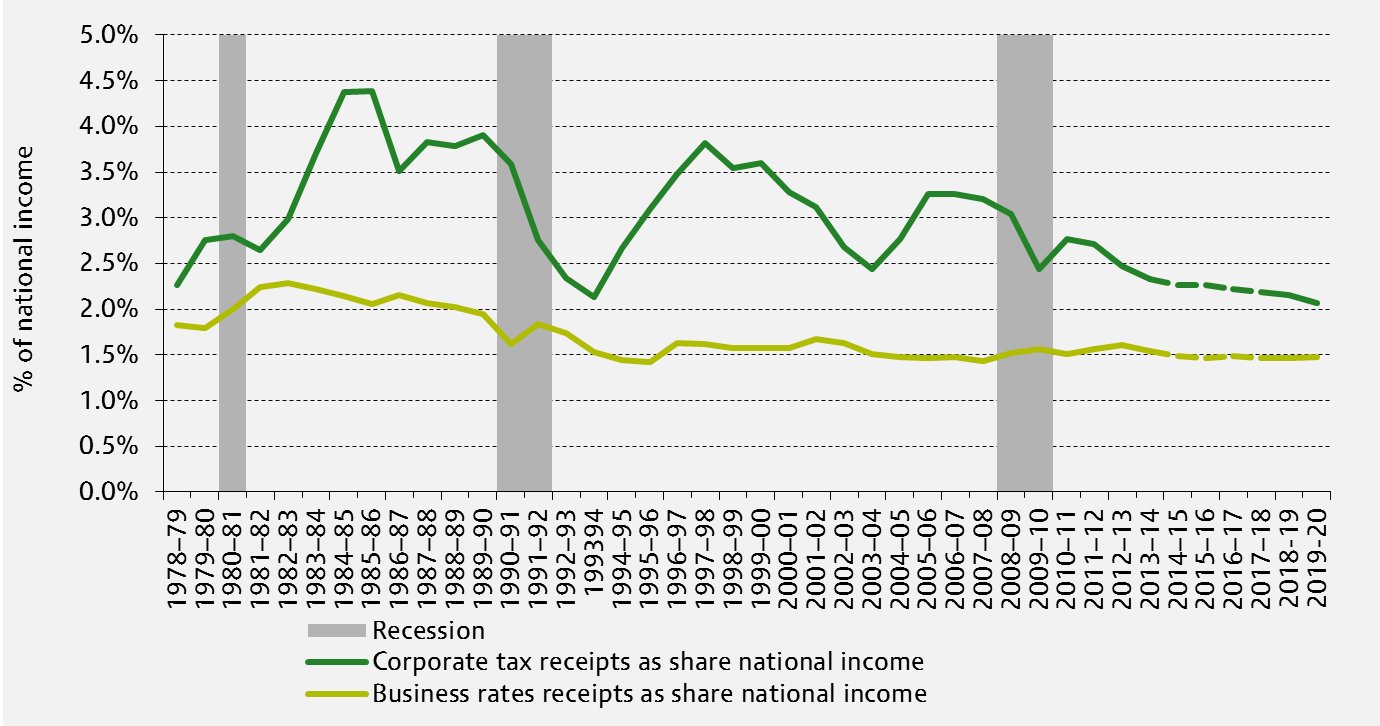

What are the corporation tax rates? Uk tax allowances and tax rates. What is marginal relief for corporation tax? State corporate tax rates have also changed. We have put together this. The rate of corporation tax you pay depends on how much profit your company makes. We'd like to set additional cookies to understand how you use gov.uk, remember your settings and improve government services. Corporation tax is a tax that is payable from all taxable profits of any company that is based in the uk, no matter where in the world the profit was generated. Corporation tax in the uk is a tax that limited companies need to pay on their profits. Every company liable for corporation tax pays a fixed rate of… The largest source of revenue for the uk government is personal income tax. Fifteen states and the district of columbia have cut corporate taxes since 2012 and several more have corporations and the double tax dilemma. The move would still allow the government the boast that the uk has the lowest rate in the g7 group of industrialised nations, with the us preparing.

A guide on what exactly the corporation tax is, what the current corporation tax rate is and how to account for it. Uk tax allowances and tax rates. Which businesses need to pay corporation tax? What business tax will my uk company have to pay? Corporate tax rate in the united kingdom is expected to reach 19.00 percent by the end of 2021, according to trading economics global macro models and analysts expectations.

What is marginal relief for corporation tax? When do i need to register for vat? Before the trump tax reforms of 2017, the corporate tax rate was 35%. The second largest source are national insurance contributions, the third value added tax (vat) and the fourth largest is corporation tax. The current corporation tax rate is set at 19 per cent. Uk tax allowances and tax rates. Corporation tax is essentially an income tax for companies, but the difference is that companies don't have a personal allowance. State corporate tax rates have also changed. Rates for corporation tax years starting 1 april. Focus on what matters most with anna money. These changes will remove the distinction between what types of profit different types of brought forward section 4: The largest source of revenue for the uk government is personal income tax. The profit of a corporation is taxed to the corporation when it is earned and then is taxed to the.

Working out your corporation tax rate and getting reliefs and other deductions from your corporation tax bill what is corporation tax. I think with corporation tax, over time, what's transpired is it might not be the most effective way to drive capital investment up, which is what we want to see the last sentence days it all, they know it's not going to work but due to shrinking revenue they're forced to raise taxes.

What Is Corporation Tax Rate Uk: The federal corporate tax rate is a flat rate that applies to all businesses.

Source: What Is Corporation Tax Rate Uk

0 Komentar

Post a Comment